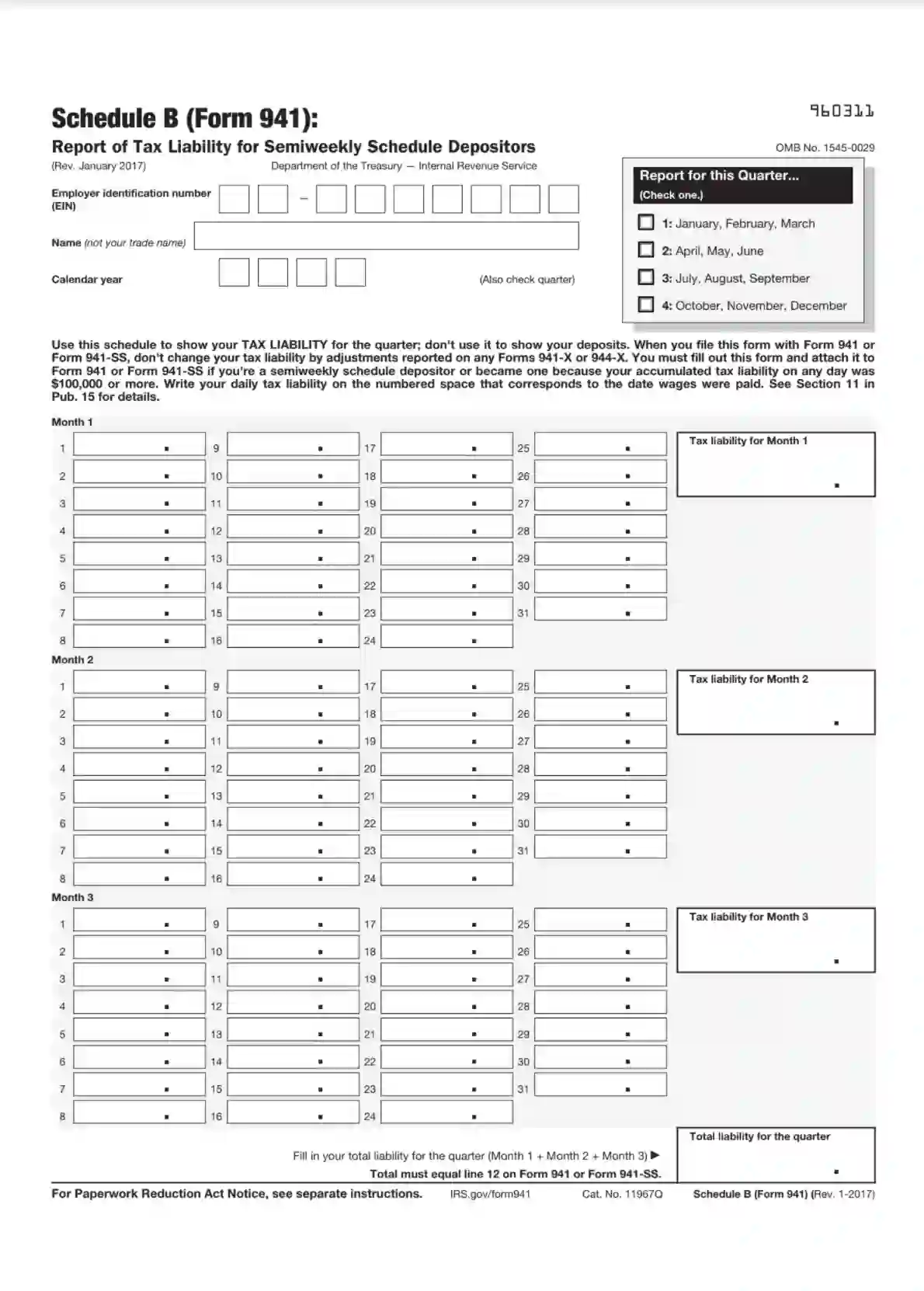

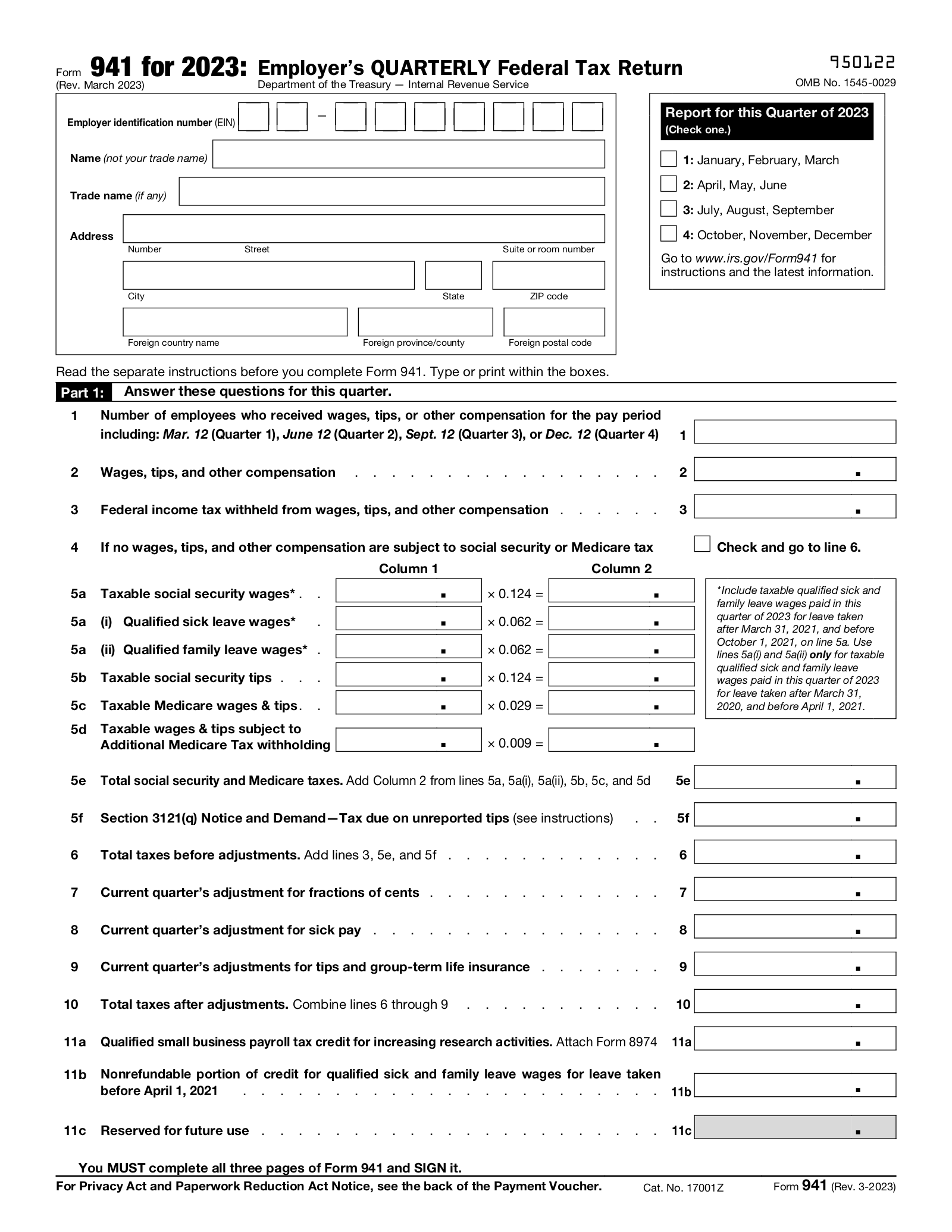

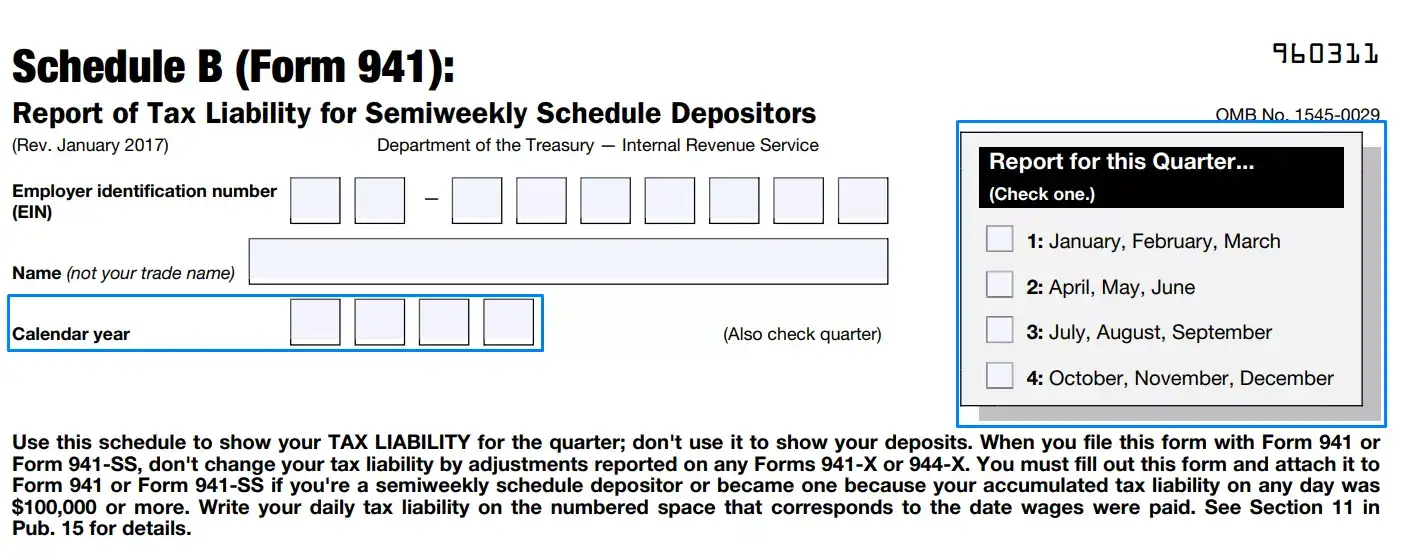

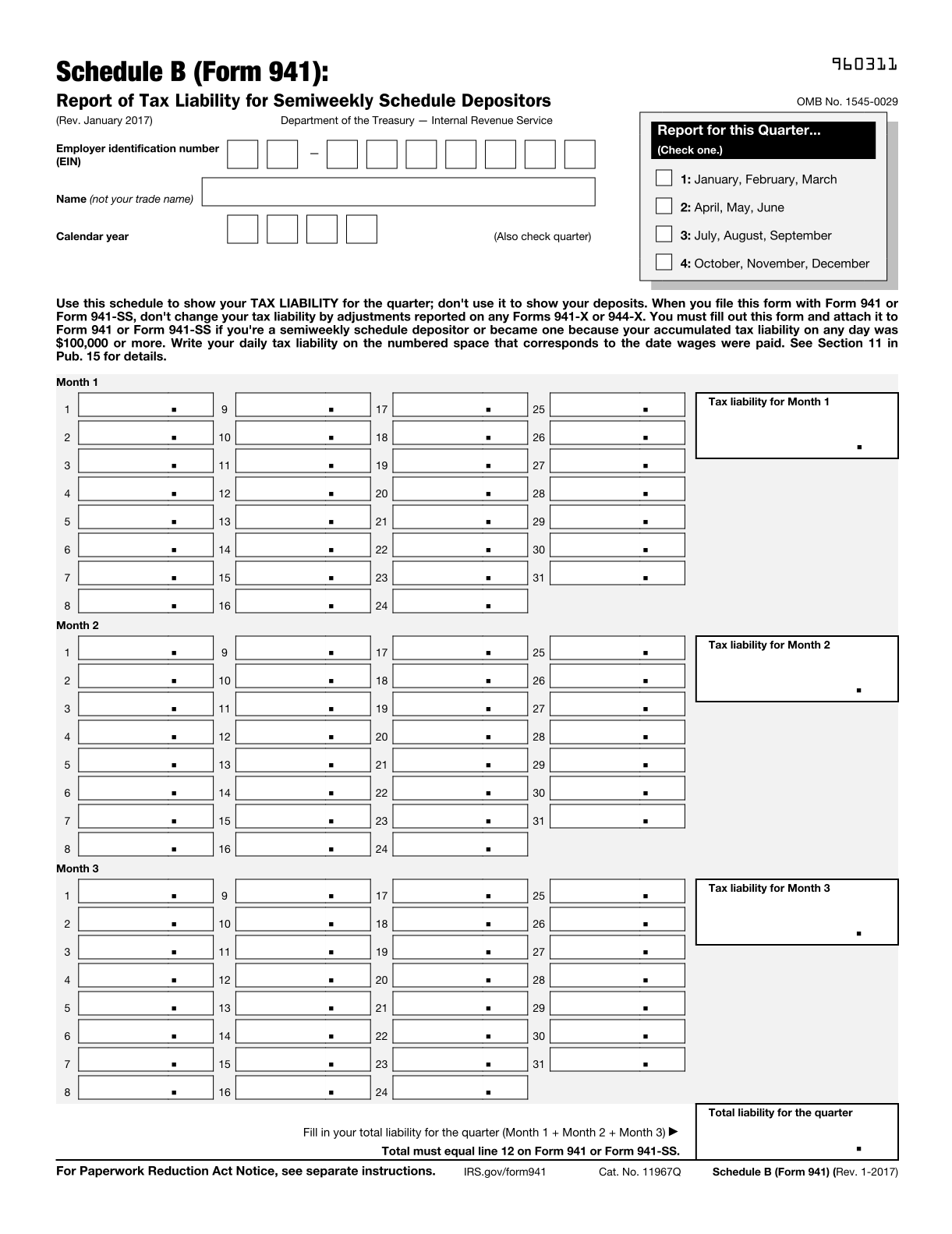

Schedule B Form 941 For 2024

Schedule B Form 941 For 2024 – The cost-of-living adjustment released in October last year will affect all welfare benefits sent in 2024. Here’s when to expect Social Security payments. . IRS form 1099-DIV helps taxpayers to accurately You might also need to fill out a Schedule B if you received more than $1,500 in dividends for the year [0] Even if you didn’t receive a .

Schedule B Form 941 For 2024

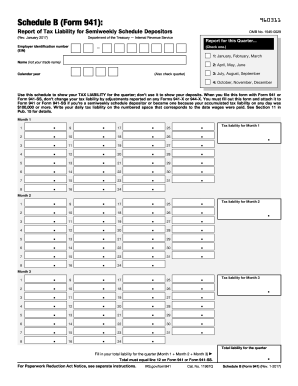

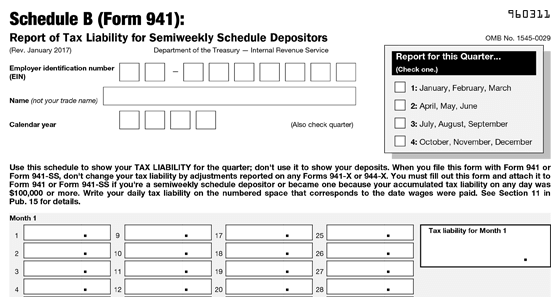

Source : form-941-schedule-b.pdffiller.comIRS Schedule B Form 941 ≡ Fill Out Printable PDF Forms Online

Source : formspal.comForm 941: Employer’s Quarterly Federal Tax Return – eForms

Source : eforms.comIRS Schedule B Form 941 ≡ Fill Out Printable PDF Forms Online

Source : formspal.comSchedule B (Form 941) (Report of Tax Liability for Semiweekly

Source : hancock.ink2017 2024 Form IRS 941 Schedule B Fill Online, Printable

Source : form-941-schedule-b.pdffiller.comIRS Form 941 Schedule B for 2023 | 941 Schedule B Tax Form

Source : www.expressefile.comIRS Schedule B Form 941 ≡ Fill Out Printable PDF Forms Online

Source : formspal.comSemi Weekly Depositors and Filing Form 941 Schedule B | Blog

Source : blog.taxbandits.comInstructions for Schedule B Form 941 Rev March Instructions for

Source : www.signnow.comSchedule B Form 941 For 2024 2017 2024 Form IRS 941 Schedule B Fill Online, Printable : Schedule K-1 (Form 1041 have to include a copy of this form when you file your tax return unless backup withholding was reported in Box 13, Code B. The fiduciary will send a copy to the . You pay capital gains taxes with your income tax return, typically using Schedule D. The data from Form 1099-B helps you fill out Schedule D and Form 8949 if needed. If you owned an asset .

]]>